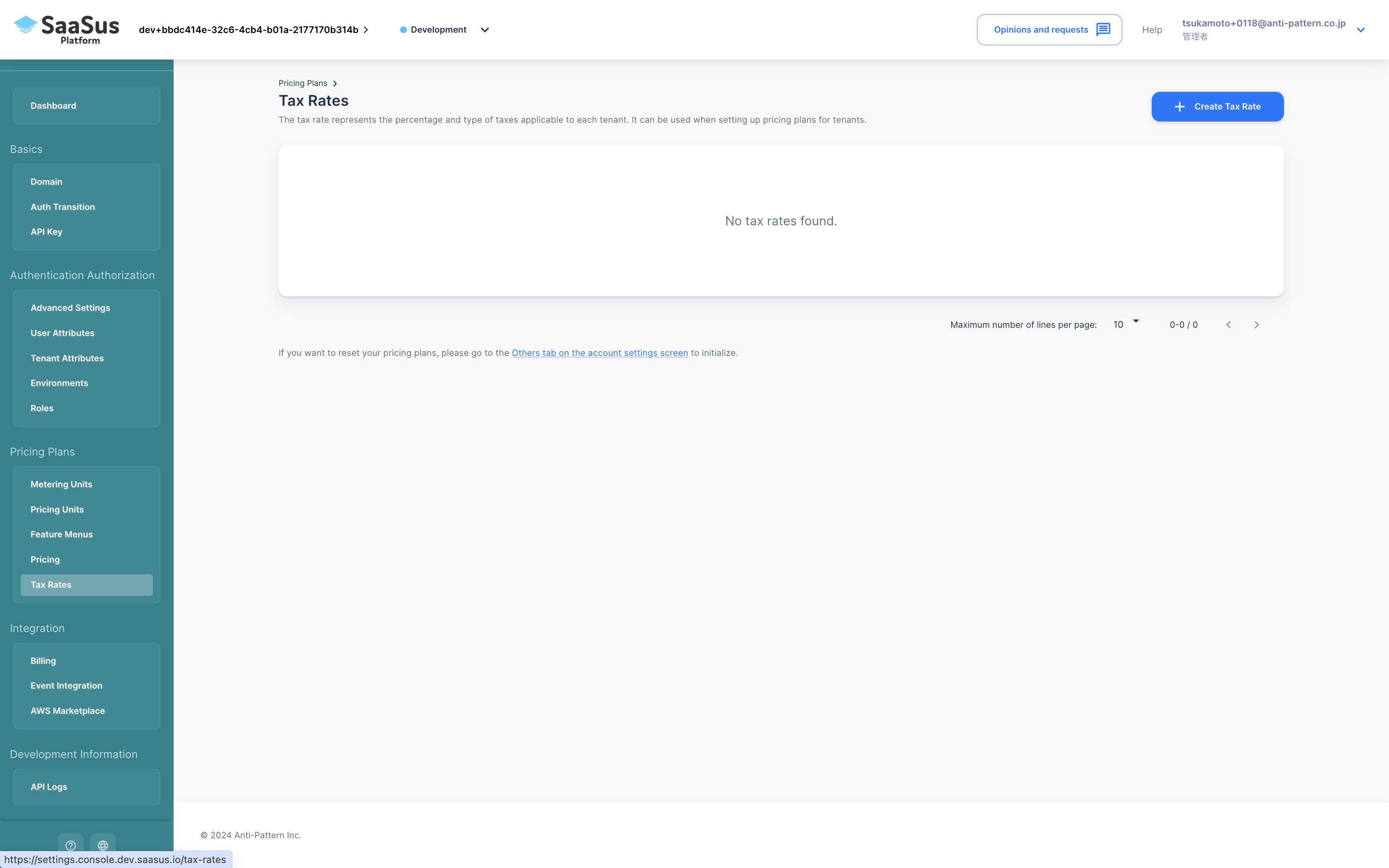

Tax Rate Settings

Tax rate settings define the type and percentage of taxes (such as consumption tax) applied to each tenant's pricing plan.

When configuring a pricing plan for a tenant in the SaaS Operation Console, you can select a tax rate along with the plan.

info

About consumption tax displayed on invoices

Japan’s qualified invoice system began on October 1, 2023.

A “qualified invoice” is a receipt or invoice that includes consumption tax details, required for calculating tax amounts when filing taxes.

https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/invoice.htm

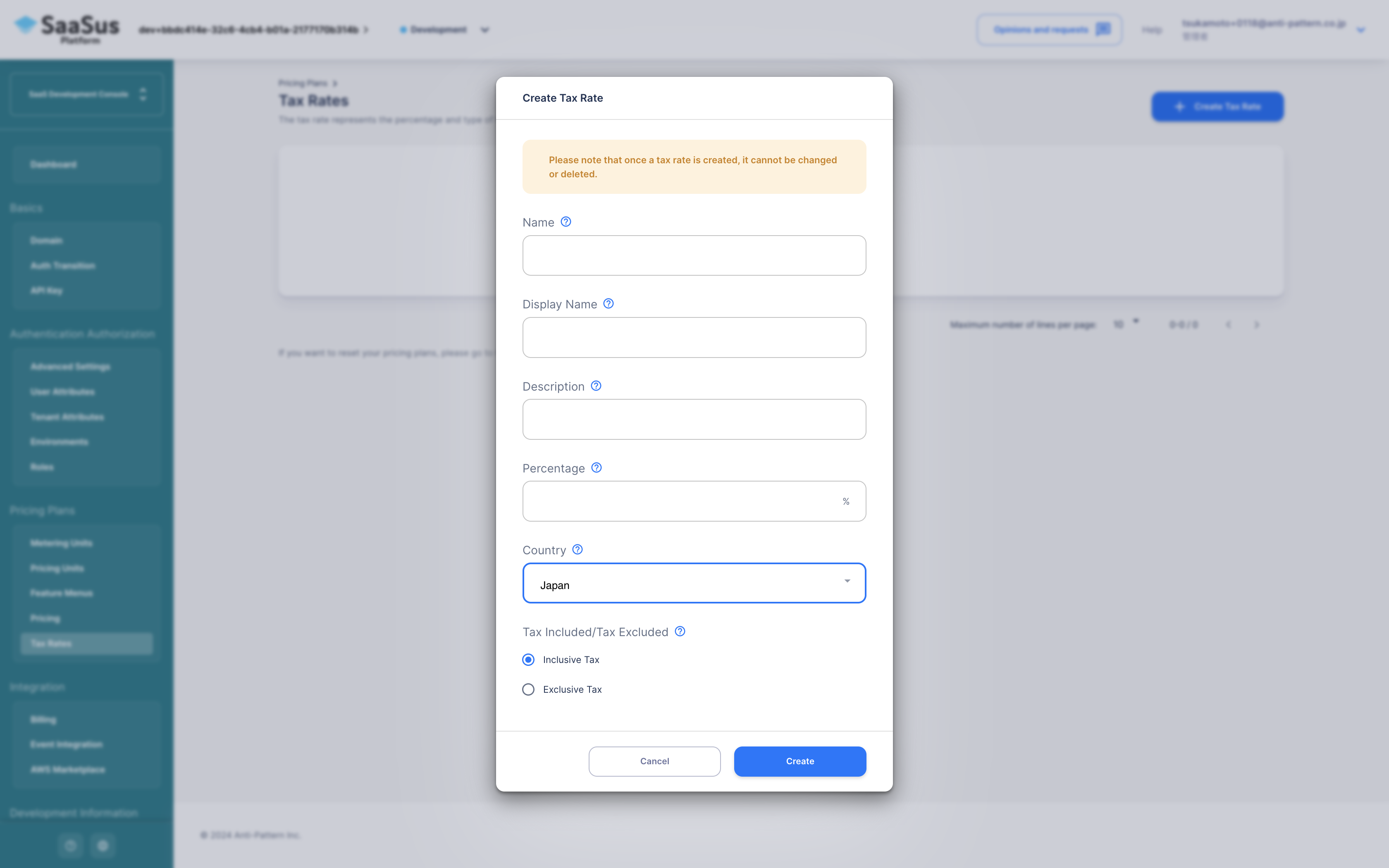

Creating a Tax Rate

- Go to

Pricing Plan -> Tax Rate Settingsin the SaaS Development Console

- Click on

Create Tax Rate

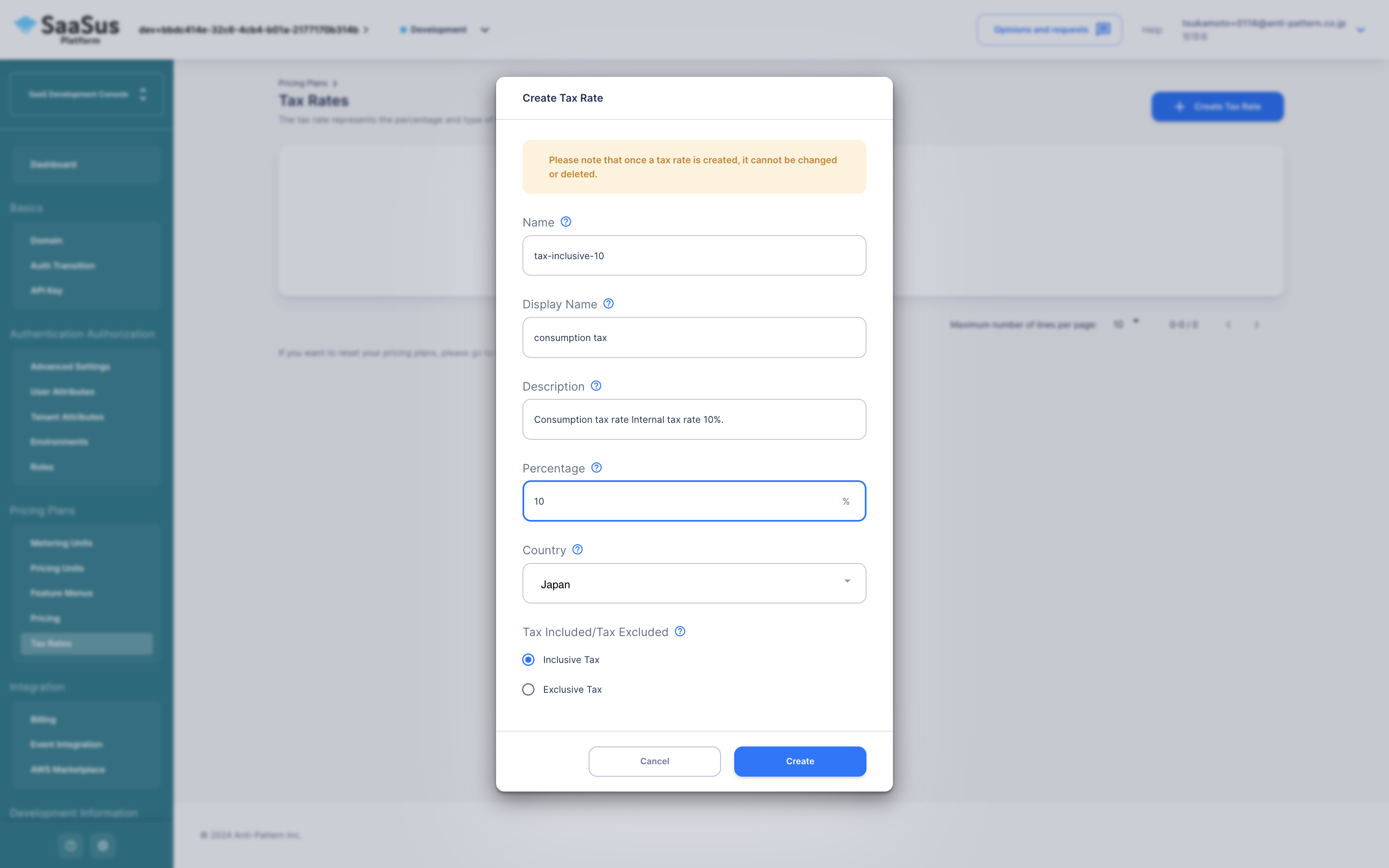

- Fill in the required fields in the tax rate creation form:

| Field | Description |

|---|---|

| Tax Rate Name | Unique identifier used in the system (must be unique) |

| Display Name | Name shown on invoices (if integrated with Stripe) |

| Description | Human-readable explanation of the tax rate |

| Percentage | The tax rate to apply (e.g., 10 for 10%) |

| Country | Country where the tax applies |

| Inclusive/Exclusive | Whether the tax is included in the price or added on top |

caution

Once created, tax rates cannot be modified or deleted. Please review carefully before saving.

After completing the form, click Create to save the tax rate.