Stripe Integration

This page explains how to integrate Stripe with the SaaS Development Console to streamline billing and invoice management.

Information such as pricing plans and tax rates configured in the SaaSus Platform will be automatically synced to Stripe and used in the invoicing process.

If you do not use Stripe, this configuration is not required.

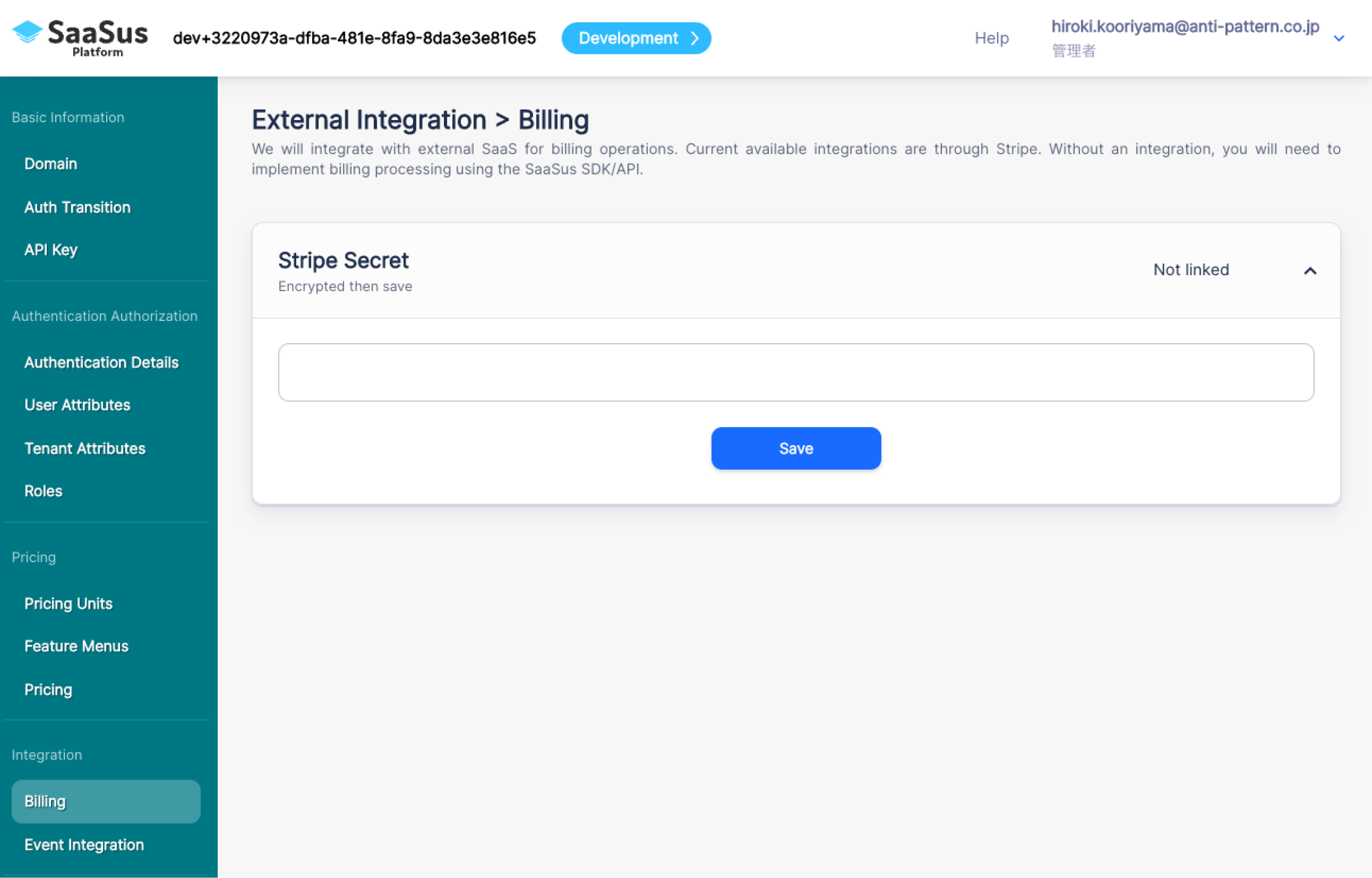

Registering the Stripe Secret Key

To enable Stripe integration, register your Stripe secret key in the SaaSus Platform.

- Go to the External Integrations menu from the SaaS Development Console

- Enter your Stripe Secret Key

- Click Save

Once completed, future pricing plan and tax rate configurations will automatically be sent to Stripe.

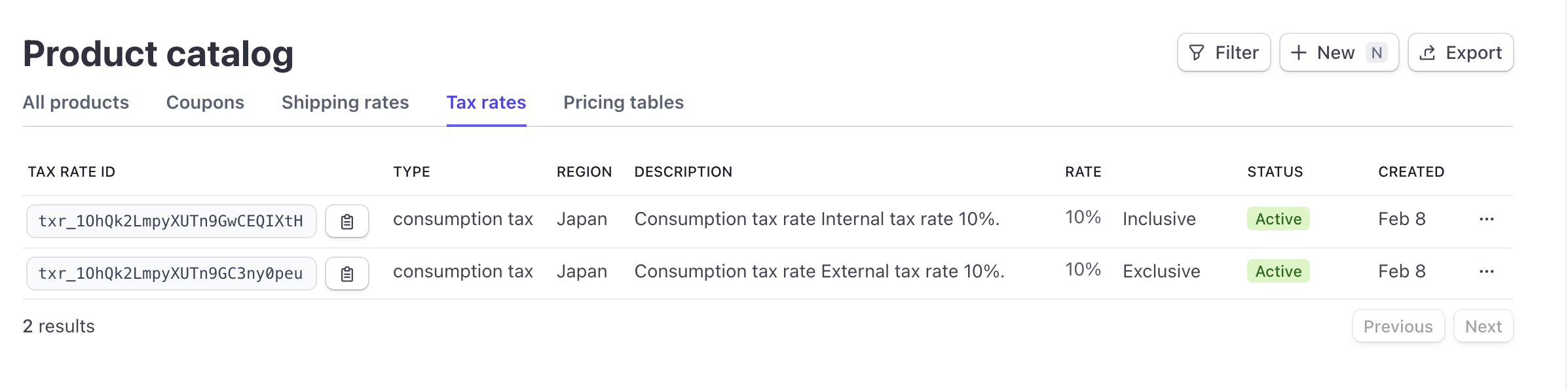

Tax Rate Mapping to Stripe

Tax rates configured in the SaaS Development Console will be reflected in Stripe as follows:

| Stripe Column | SaaS Development Console Field | Description |

|---|---|---|

| - | Tax Rate Name | Internal identifier (must be unique) |

| Type | Display Name | Displayed on Stripe invoices (if integrated) |

| Description | Description | Human-readable label for the tax rate |

| Rate (%) | Percentage | Numeric value of the tax rate |

| Region | Country | Country where the tax applies |

| Inclusive/Exclusive | Inclusive/Exclusive | Indicates whether the tax is included in the amount or not |

Example: Invoices Issued with Stripe

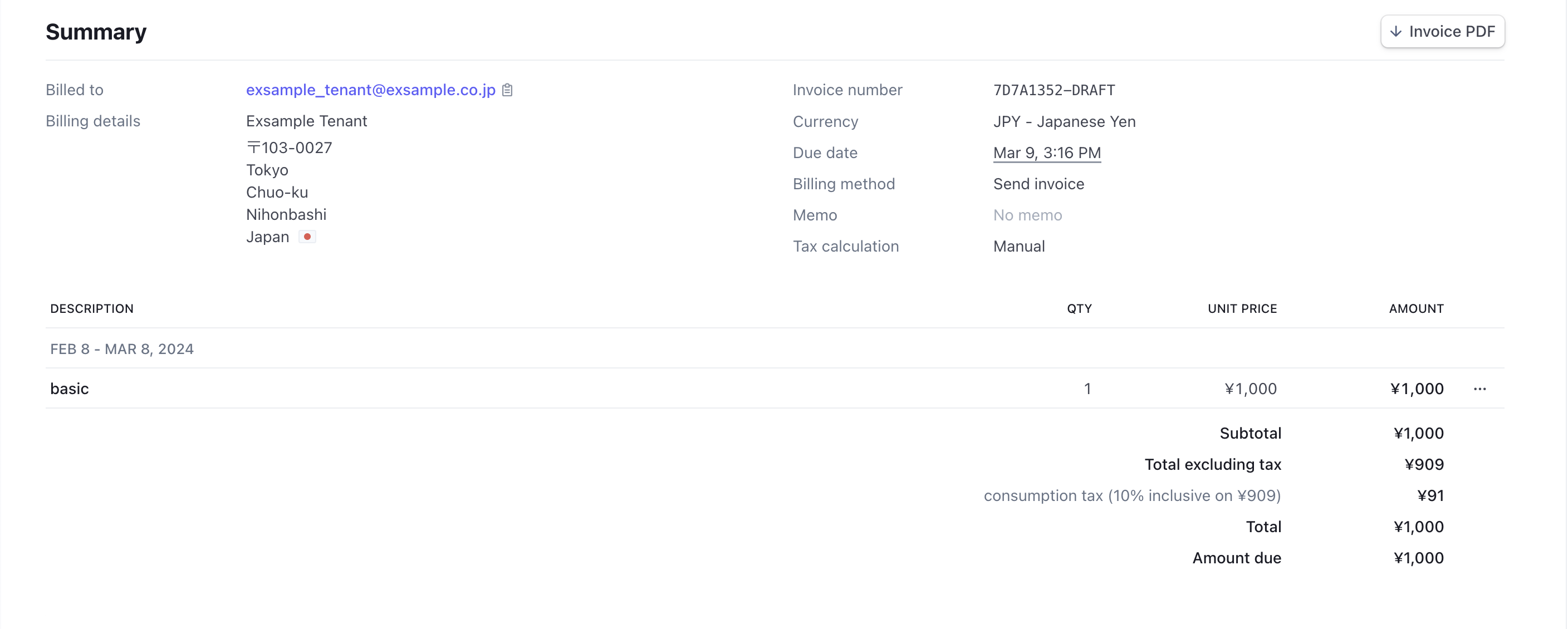

Based on the configured tax settings, Stripe will generate invoices accordingly — here are examples for inclusive, exclusive, and no tax cases.

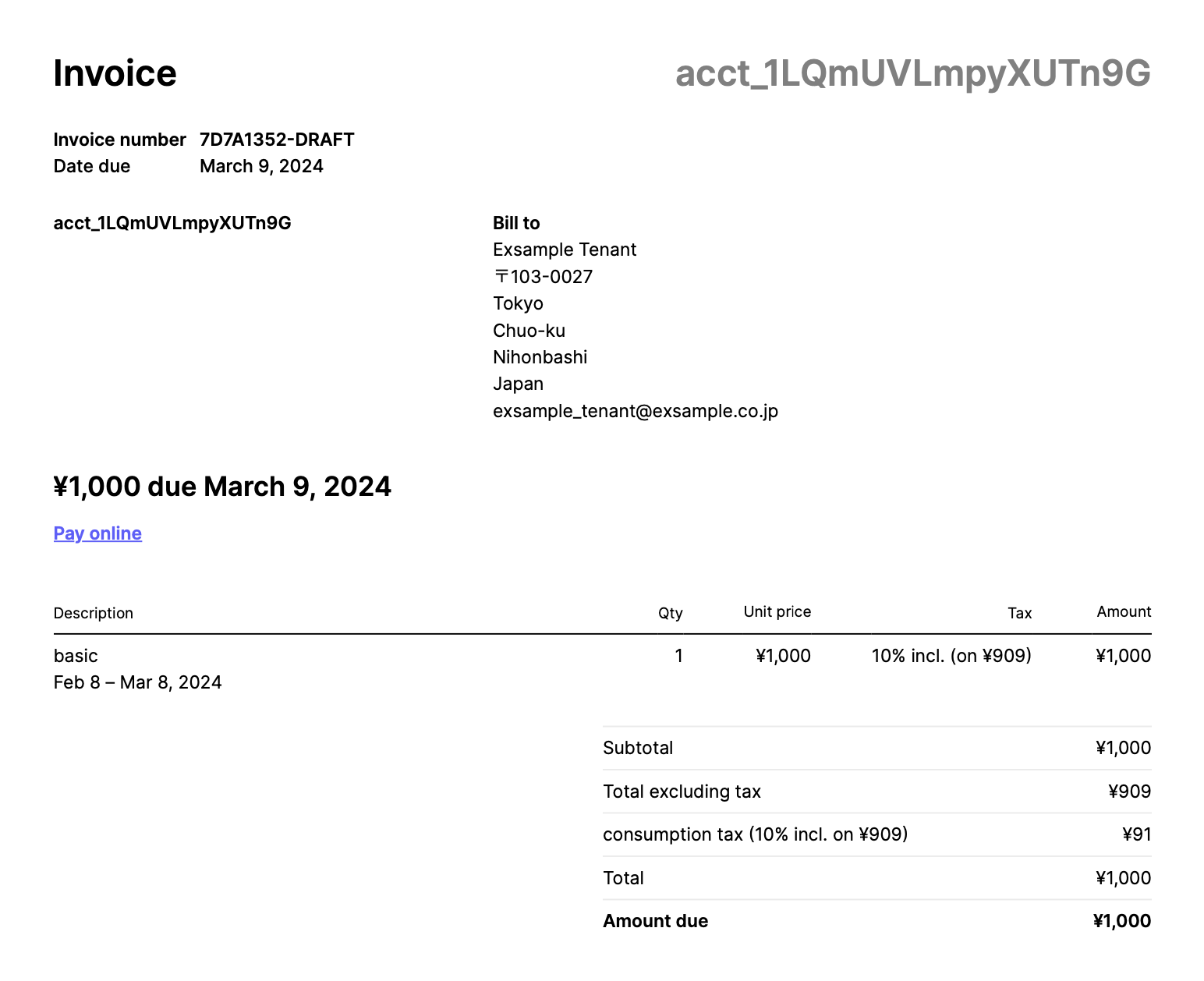

Invoice with Inclusive Tax

Invoice View

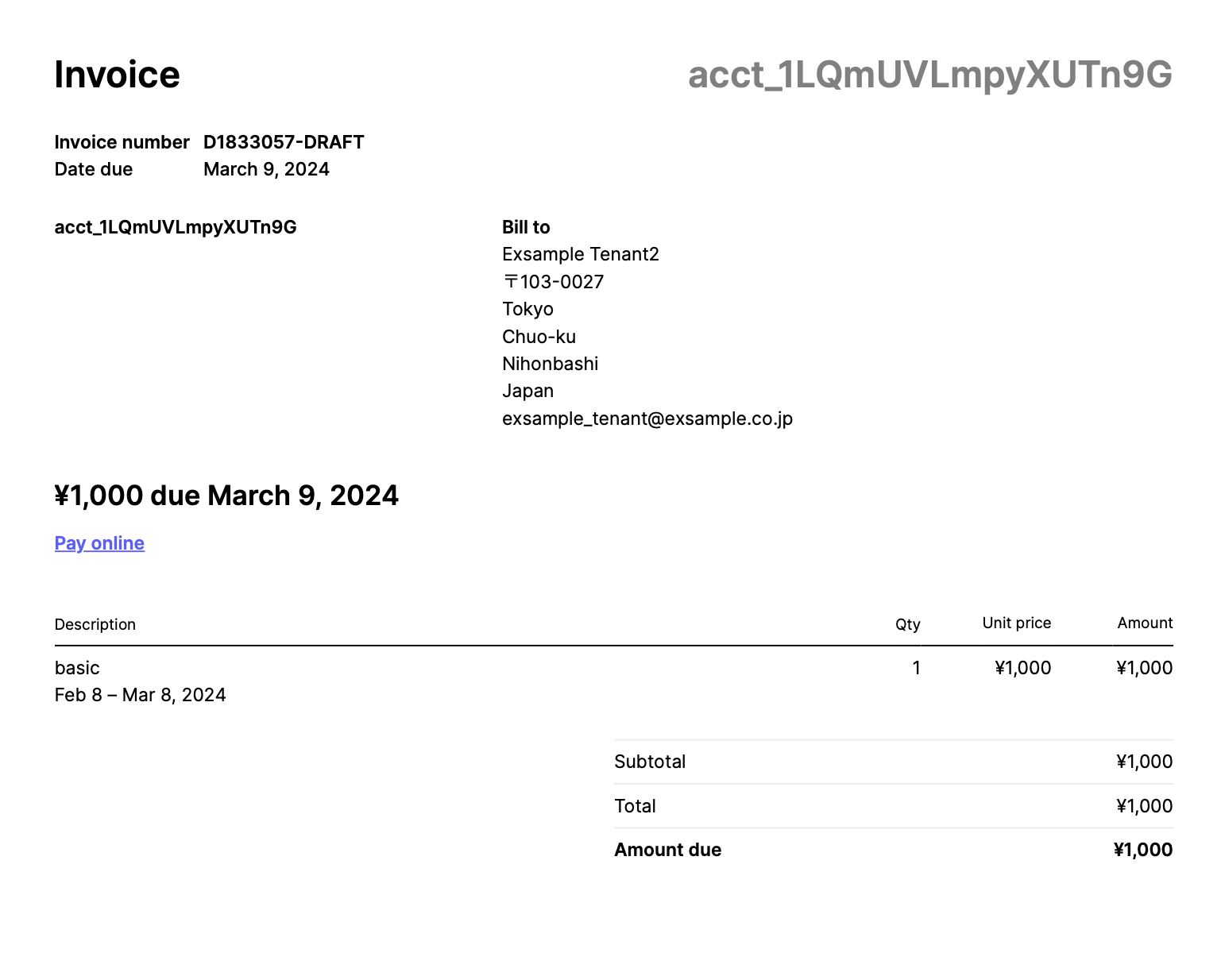

PDF Version

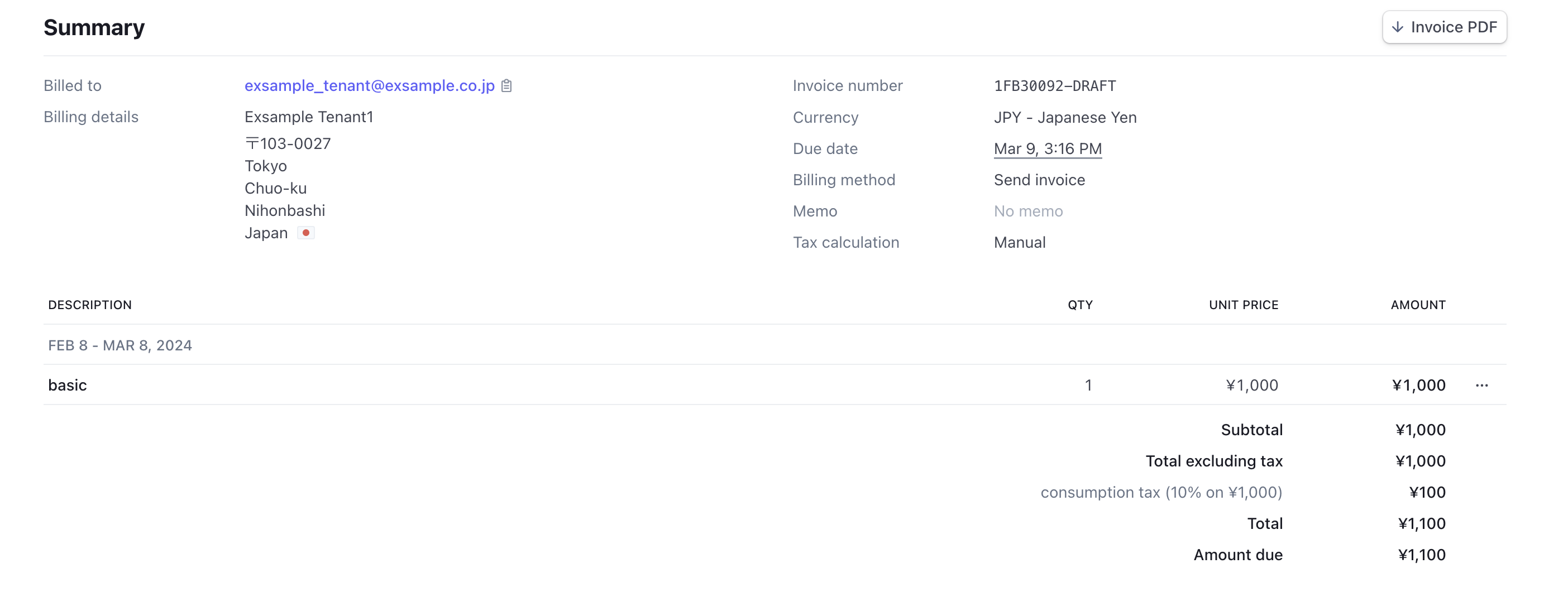

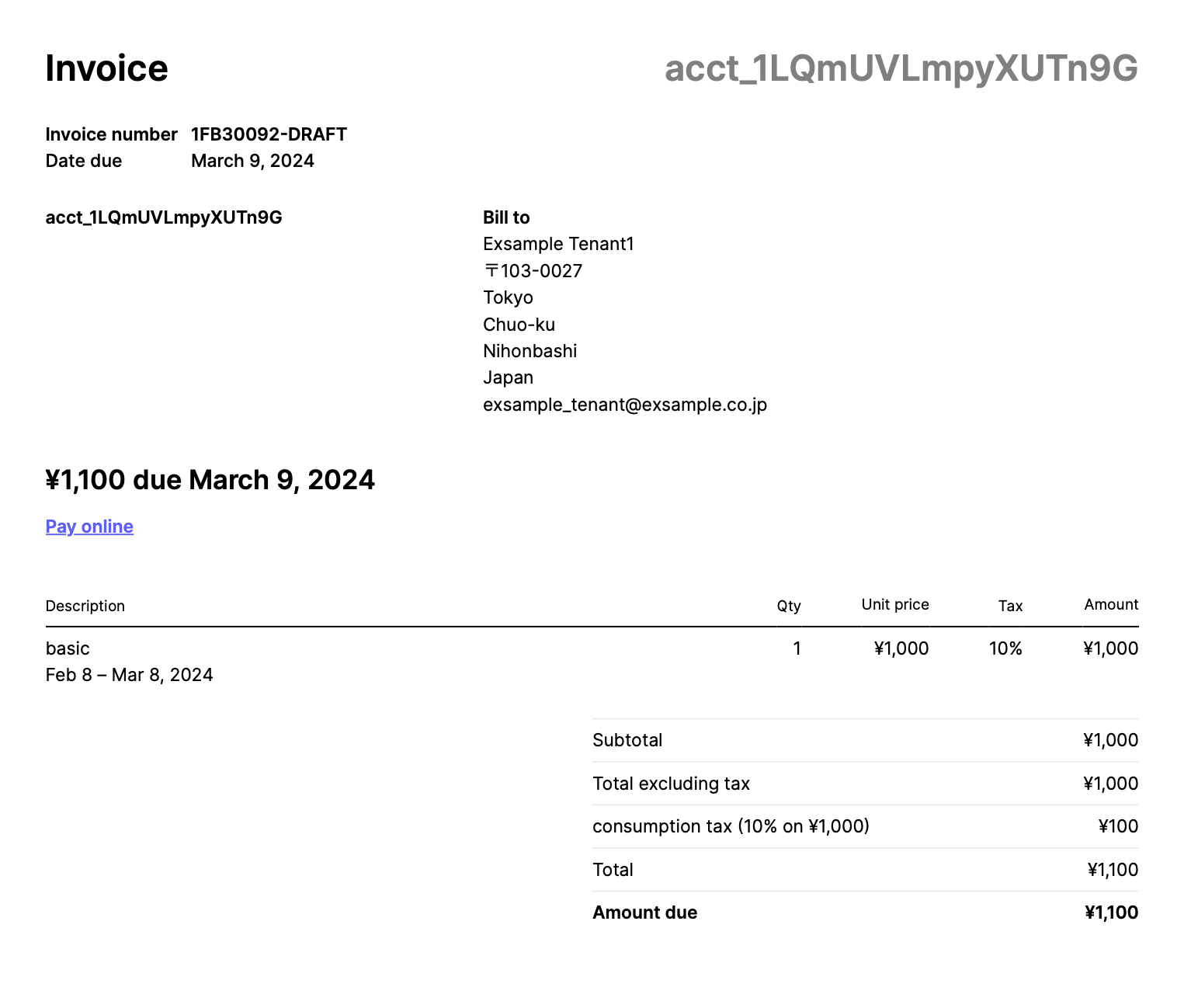

Invoice with Exclusive Tax

Invoice View

PDF Version

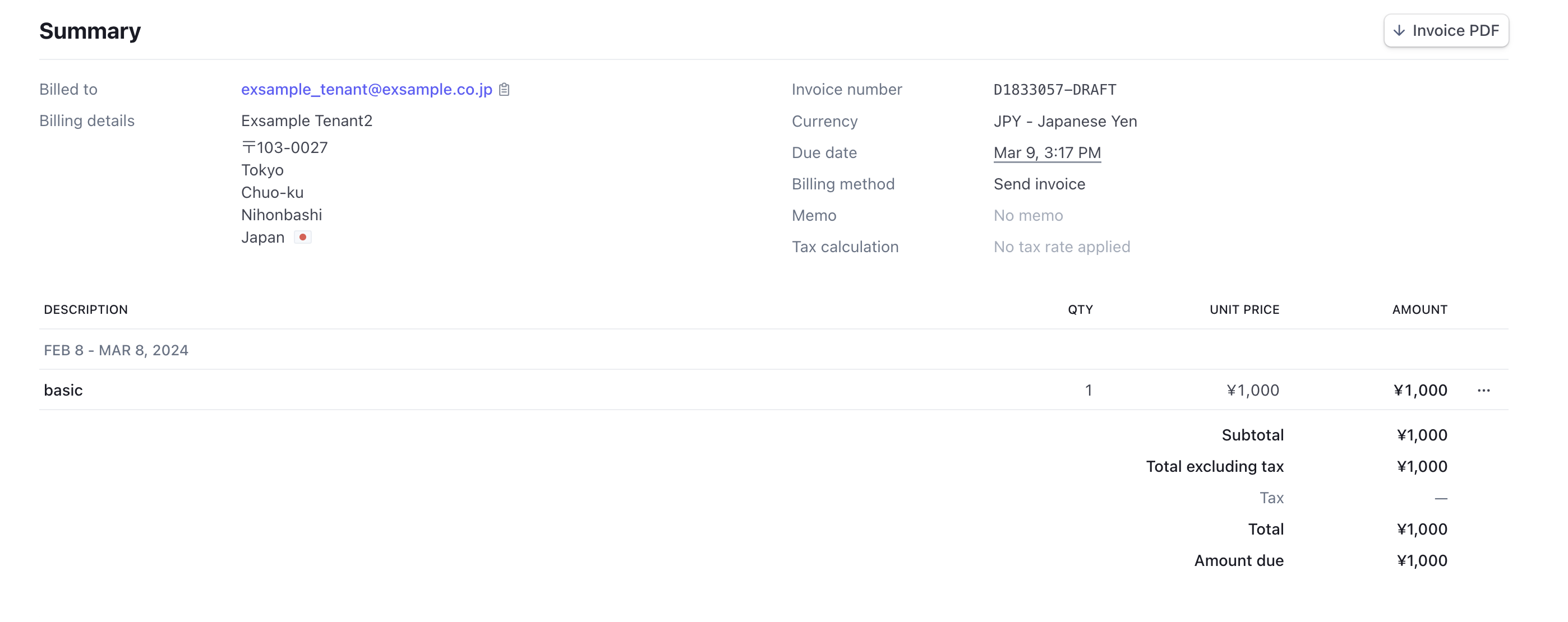

Invoice without Tax Settings

Invoice View

PDF Version